Let's keep Ethereum Classic Classic

Arguing against the proposed protocol-layer treasury for Ethereum Classic

2021.09.04 (Updated 2021.10.21)

We decentralists are committed to keeping blockchains open, neutral and immutable. We’re committed to keeping blockchain systems decentralized. This informs all our actions and positions towards any developments in the crypto world and beyond. All attempts to violate any of the key blockchain characteristics should be fought.

When ETC rose from the ashes of The DAO Hack in July 2016, A Crypto-Decentralist Manifesto was one of the very first items to appear on the Ethereum Classic website and was a seminal document that laid out ETC's raison d'être. We begin with this quote to remind ourselves of where Ethereum Classic came from, where it derives it's value, and what will remain an integral part of it's future.

We recognize that the value proposition of Ethereum Classic is uniquely reliant on a strict adherence to it's core principles, which uphold decentralization. ETC is is presently one of the preciously scarce truly decentralized cryptocurrency projects, and for this reason we believe it's sanctity is worth defending.

The future will rely on truly neutral blockchain platforms like ETC. If they are to remain antifragile and uncaptured by special interests, the principles of decentralization need to be thoroughly, vigorously and relentlessly defended. We say without hyperbole that protecting ETC is protecting the future of humanity; for the greater good, there is no hill more important to die on.

A clear and present threat to the future of Ethereum Classic exists in the form of ECIP-1098, aka The Treasury Proposal. This document will attempt to deconstruct The Proposal in order to preemptively avoid an agonizing chain-split event that is looming on the horizon should it be forced upon us.

This document is a bit long, so there is a TL;DR version if you are limited on time.

Table of Contents

- Housekeeping

- The Treasury Proposal

- Against The Treasury

- First, Principles

- Broken Promises

- The Sinking Ship

- Blockchain Seppuku

- The Three Pillars of Decentralization

- Protocol Neutrality

- An Unequal Footing

- Natural vs Artificial Contribution

- Squaring the Coordination Problem Circle

- Fair Shares

- Competition for the Neutrality Niche

- The Centralization Gravity Well

- Misallocated Resources

- Perverse Incentives

- The Client Triopoly

- Non-Essential Workers

- Worse than a Premine

- 1,825 Days Later

- The Ethereum Classic Foundation

- No Free Lunch

- Technical Issues

- Ethereum Classic Classic

- Tough Love

- Keeping Promises

- Minimum Necessary Controversy

- Interdependence Independent

- Unique Selling Points

- Miners' Revolt

- Replay Attacks

- Chain 61: Checkmate?

- Hard Fork Episode 2: Revenge of the Decentralists

- Asymmetric Warfare

- Free Money

- Seizing the Memes of Production

- False Consensus

- A Game of Chicken

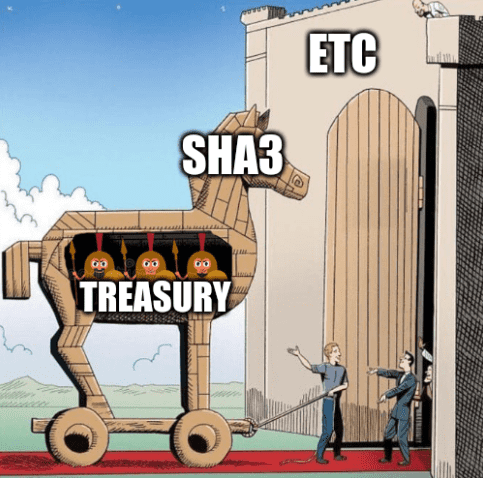

- The SHA3 Trojan Horse

- The Nuclear Option

- Treasury Alternatives

- Conclusion

Housekeeping

We hope to spark discussion within the ETC community about the pros and cons of implementing a treasury in order to facilitate consensus creation about whether or not to implement such a proposal. Our only focus is the success of Ethereum Classic and hope to achieve this in the least disruptive way possible.

Whilst lively debate is a healthy aspect of any community we hope that the conversation can remain civil and doesn't cause any significant rifts or rage-quits. As such, before we get in to the meat of the topic, we want to set the tone in what we hope can be a good-spirited exchange of ideas.

Gratitude

We accept that those advocating for a treasury believe they are acting in the best interests of ETC. We recognize that The Proposal is intended be a way to fund the continued development of the 3 major ETC clients for the purposes to ensuring it's future. Both sides of the debate ultimately want the same thing in this regard.

Moreover, we greatly respect and appreciate the valuable contributions to Ethereum Classic that it's many participants, including The Treasury Proposal Beneficiaries, have made and we wish to see them to continue.

Conflicts of Interest

We will refrain from singling out the potential financial motivations of specific groups or individuals. Such claims distract from the main debate and are impossible to qualify. Any references made to financial conflicts of interest will apply to any rational actors in similar positions, and are made purely for clinical game-theory analysis purposes. At no point are we suggesting foul play from any real world parties in this regard.

Sensemaking

There are many different viewpoints among Treasury Beneficiaries and non-Beneficiaries alike; some supporting and some rejecting this proposal. On both sides, there may or may not be financial incentives at play that cause certain viewpoints to be amplified, which may cloud the waters of discussion or create a false sense of consensus. This is true of blockchain communities in general and not specific to this debate.

In this space, the reasoned judgement of individuals of supreme importance; the coming and going of minds is what makes or breaks a project. The strategy of simply "going with the majority" is a recipe for failure (or getting rug-pulled), as knowing what the majority is really thinking is impossible. Regardless of the outcome, conscientious participants have the responsibility to reach their own conclusions rather than going with whatever appears to be the prevailing wisdom.

Contribute

This document may be updated from time to time and can be contributed to by anyone; if you'd like to add any points or corrections you are welcome to submit a Pull Request to the github repository. Beyond that, we hope this message can spread far and wide, so please like, share, subscribe, hit the bell icon and print hard copies out to mail to all your friends and family.

License

Apart from the images, this document is released to the Public Domain under CC0 (No Rights Reserved) - you are free to copy it, remix it, resell it, do whatever you want with it, and attribution is not required.

Updates

If this document is edited and responded to over time, a summary of changes and feedback will be made here:

- 2021.10.21: Add response to ECIP-1098 being withdrawn

- 2021.09.09: Mention that 5 year time limit is not part of ECIP

The Treasury Proposal

Originally introduced in August 2020, The Treasury Proposal, most recently known as Ethereum Classic Improvement Proposal #1098 is presented as a way to secure funding for development of Ethereum Classic.

We will first briefly summarize The Treasury Proposal, but we encourage the reader to familiarize themselves with the the implementation details of ECIP-1098, the treasury smart contract repository, and dive into some of it's proponents' arguments in favor.

ECIP-1098 Summary

The primary motives of [The Treasury] is to establish a stable and reliable funding mechanism for independent teams, each of whom are capable of both maintaining core clients and evolving the development of the Ethereum Classic platform [...]

The key implementation details of The Proposal are:

- A "dev tax" will be introduced, whereby 20% of the mining rewards from each block will be diverted away from miners to a special Treasury contract

- The proposed contract will distribute these funds to the following Beneficiaries:

- 30% to IOHK (Mantis Client)

- 30% to ETC Labs (Core Geth)

- 30% to ETCCoop (Hyperledger Besu)

- 10% to Gitcoin Grants (other projects)

- A "coin vote" mechanism in this contract exists that allows the creation of proposals that can:

- Add a Beneficiary team

- Remove Beneficiary team

- Update addresses for Beneficiary teams

- Disable the gitcoin grants

- Disable the whole treasury

- Each of these proposals can only be passed if:

- At least 35,000,000 (~30% of all) ETC is "locked" for a given proposal

- Locked ETC is deposited in the contract and cannot be moved for 30 days

- 51% of the locked ETC must signal support for The Proposal to pass

- Although not mentioned in the ECIP itself, a time limit of 5 years is being discussed, after which The Treasury is disabled

- As The Treasury Proposal changes the Ethereum Classic protocol in a non-backwards-compatible way, it's implementation will require a hard fork

A Moving Target

In this document we will be focusing on the latest publicly available version of The Treasury Proposal (as of September 2021), which has not changed much since it's announcement in 2020. It is likely that new versions are being worked on behind the scenes by Treasury Proponents, which are yet to be released, but we intend to update this document if such updates appear.

Until The Treasury is actually implemented, it is is a moving target and subject to modification, so whilst our current criticisms of some implementation details may become irrelevant for newer versions, our opposition will remain as long as a protocol-layer dev tax remains part of The Proposal.

Against The Treasury

We believe that there are three main reasons why The Treasury Proposal should be rejected by the ETC community:

- It goes against ETC's principles

- It is unlikely to achieve it's stated goals

- It introduces an unfair risk to ETC holders

With these broad objections in mind, we will attempt to deconstruct The Proposal piece by piece by addressing what we perceive to be a variety of technical, economic, social and philosophical issues. We believe that together these issues far outweigh any potential benefit from introducing such a system, and is very likely to have a net negative effect on Ethereum Classic.

Why Now?

It is unknown how forcefully The Treasury Proposal will be pushed by it's proponents, but it appears there are significant players supporting it and is being seriously considered by the the community. For this reason, now is the time for it to be strongly rallied against, and why we are publishing this document.

We will address flaws in The Treasury Proposal on multiple levels and shine a light on how it is not just incompatible with decentralist philosophy but is counter-productive, exhibits irreconcilably flawed implementation details, and places the unfair burden of additional risk on anyone invested in ETC.

There may be many stakeholders who discovered Ethereum Classic in recent years and who may not be aware of it's genesis and reason for being, so we also aim to remind everyone involved why ETC is the way it is. For ETC's chain state to remain immutable, so must it's principles.

Preventing Calamity

Whatever happens, the original Ethereum vision will live on. A version of Ethereum without a the DAO hard fork and without a Treasury will always exist; Ethereum Classic Classic (or whatever it becomes known as) is a guaranteed outcome should a protocol layer treasury be implemented.

With significant push-back from enough ETC stakeholders, the inevitability of a chain-split will become obvious, which will hopefully, but not certainly, be enough for the effort to be abandoned or revised in a way that does not betray ETC's values.

First, Principles

We begin with what believe are the strongest set of arguments against The Treasury Proposal, which rely on reasoning rather than implementation details or technical issues. Regardless of particularities, protocol-layer mechanisms that aren't trust-minimized go against the core values of blockchains in general Ethereum Classic in particular.

Decentralization is King

The key value proposition of any blockchain is the extent to which it is trustless, neutral and decentralized. This is in contrast to other more centralized alternatives that offer greater 'efficiency' at the expense of these properties. The full ramifications of achieving 'efficiency' is not always revealed immediately; it often falls into the trap of optimizing for short term gain over long term sustainability.

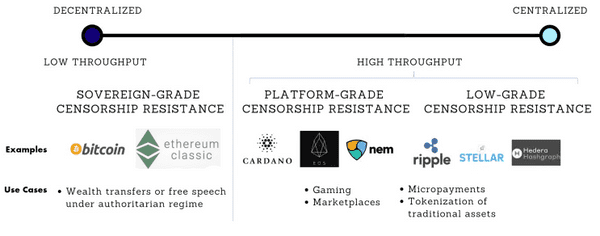

The trilemma of Scalability, Decentralization, and Security elucidates how all blockchains must position themselves in a space that balances these qualities and sacrifice some at the expense of others. We argue that ETC's specific configuration maximizes for decentralization and security, focusing on decentralization and successfully filling a niche in the blockchain market that many other less decentralized projects do not.

Ethereum Classic in particular demonstrates it's commitment to this point of view through it's founding documents, which contain explicit references to decentralist philosophy, lack of central leadership which protects it from entire categories of social attacks, and it's very existence which is a response to a centralization risk-on event on it's cousin chain - the The DAO Hard Fork.

Long Term Time Preference

Given the novelty of blockchain systems and lack of understanding about what makes or breaks them, there are many different competing ideas about how to ensure the long term success of a given project. Longevity is an often overlooked feature of blockchain design and, whilst not necessarily exciting, is of primary importance.

The core argument of this document is that The Treasury represents a shift towards centralization, which might appear to have short term benefits, but will come at the expense ETC's long term sustainability.

As decentralists, we believe that whilst ETC may suffer a relative lack of funding for development compared to other projects, this is a price worth paying and not necessarily a negative. The important factor that allows blockchains to maintain their usefulness over time is the nurturing of a philosophy that perpetuates decentralization and in turn enables longevity.

The Decentralization Spectrum

We recognize that blockchain longevity is dependant on the degree to which it is decentralized. The logic is simple: if a blockchain is dependant on a central group, it can only last as long as that group lasts. We can quantify decentralization by asking how many actors need to be compromised in order to gain control of a given system.

Many blockchains are centralized as they rely on a small set of individuals or organizations; the more extreme examples being Proof of Authority (PoA) chains such Binance Chain. These chains are inherently limited in terms of longevity by the survival of the group that operates said chain. This clear tradeoff between decentralization and efficiency means that Binance Chain can be ultra scalable and cheap to transact on, but it as the behest of both Binance and any group that can control or manipulate Binance.

Sovereign Grade Censorship Resistance

On the complete opposite side of the spectrum to PoA, Ethereum Classic in a unique position; it's maxing-out of decentralization enables it to provide humanity with long term sovereign grade censorship resistance. No force in the universe can take down or manipulate ETC's leadership, because it has none.

Ethereum Classic is even more precious than Bitcoin in one regard; it is still possible that Satoshi Nakamoto comes back and influences decision making for BTC, but for ETC, no such figure exists. Almost every other blockchain project has either known leadership or pseudo-anonymous leaders that could be manipulated, but ETC, the rare and miraculous gift from the heavens that it is, does not, and as such has the rare potential to achieve otherwise unseen levels of decentralization.

The way to leverage this unique situation (which ETC is very lucky to have and why we see The DAO Hard Fork as a moment for celebration as rather than for grievance) is to continually strive for trust-minimization; any decision that does not honour these ideals must be rejected.

The implementation of The Treasury Proposal would create a significant quantitative shift away from decentralization as it would take a previously neutral to all parties chain and grant a specific group of individuals an elevated level of privilege as far as the protocol is concerned, resulting in an unarguably more centralized protocol that is easier to attack socially.

ETC losing it's decentralization would be a tragedy, and would squander a rare gift at a time when humanity really can't afford to.

Principles over Pragmatism?

Should ETC holders really care about people nerding out about upholding pompous inconsequential esoteric principles? Shouldn't we just be pragmatic rather than clinging on to vague dogmatic ideas about decentralization?

Our response to this is that particularly in the case of ETC, pragmatism is downstream of principles. Since day 0 (block 1,920,000), ETC has sold itself on these principles and has attracted it's sizable following primarily because of these principles. Many of the developers and contributors working on ETC are only here because of those goals, and have contributed based on this understanding.

The long term value proposition of ETC, and thus (whether you're a day trader or a long term holder) the source of it's monetary value, is reliant on these principles being respected and maintained. It is the essence of Ethereum Classic, and if abandoned, will be sacrificing not just a significant unique selling point, but it's very soul.

Attacks on the neutrality and decentralization of ETC are particularly egregious as they directly contradict the messaging that has enabled ETC to survive; they break the social contract in the same way that Ethereum's "Build Unstoppable Applications" did when it stopped The DAO.

Because of this, we predict that should The Treasury Proposal be forced ahead, enough of the community will be compelled to respond and to defend ETC's core principles by rejecting the forked treasury version and working on the non-forked Ethereum Classic Classic.

Later, we'll go into detail about how things are likely to pan out should a treasury be forced through, but for now we'll lay down the claim that in the case of ETC, because of this potential exodus, it is not pragmatic to implement any protocol layer change that even has the perception of abandoning it's core principles.

Moreover, those principles are in place primarily for pragmatic ends, and we believe that any slight shift away from protocol neutrality is likely to tip the scales and cause the protocol to tumble down the The Centralization Gravity Well.

Broken Promises

To understand what's "wrong" about The Treasury Proposal we just have to look at ETC's founding documents. Back in July 2016 when Ethereum Classic had only existed for a matter of weeks, several important documents appeared that were heralded as a formalization that explained of ETC philosophy. They were posted on early versions of the main Ethereum Classic website and were widely shared and upvoted on Reddit, laying out the rules of engagement for ETC participants.

We a believe that any developments that go against the wording or the spirit of these documents should be opposed and will be recognized as a bait-and-switch that contradicts the advertised and agreed upon social contract for all of it's past and present contributors.

Not only does narrative divergence risk alienating a sizable portion of existing proponents, but it also calls into question the integrity of any other promises that have been made or may be made in the future. This includes those promises embedded in The Treasury itself, such the idea that it is temporary and limited.

We can see that if we disregard the established rules of engagement an important rubicon is crossed that opens the door to the rationalization of just about anything in the name of "rescuing" ETC. If its okay to sacrifice promised neutrality, why not revise the monetary policy, or maybe tamper with problematic transactions?

We anticipate that a critical mass of ETC supporters, both OGs and newcomers alike, will on a personal level feel morally obliged to not break their promises and, if the time comes, will support whichever side of a chain split that continues to uphold them.

As history has shown, broken promises lead to chain splits.

The Ethereum Classic Declaration of Independence

We will first take a look at the founding document of ETC; the so called "Declaration of Independence". As ETC is decentralized, there are no official endorsements that can be made on behalf of the protocol or community, but given it's universally agreed upon spirit at the time of the Hard Fork, this is probably the closest thing ETC will ever get to an "official" stance.

The document holds not just as a point of reference but as a social contract; all participants since it's publication (i.e. from just about day 0 of ETC), can expect to contribute based on the understanding laid out in this declaration. As such, any attempt to betray these values discredits the past contributions that made ETC what it is today - be it CPU cycles, code commits, blog posts, comments, tweets, memes, money, or whatever.

The Declaration begins:

We believe in a decentralized, censorship-resistant, permissionless blockchain

These are the desirable properties of any blockchain; they are primary, and are at the heart of Ethereum Classic.

The pure decentralized nature of ETC will be abandoned if a treasury is implemented, as it will mean that a new class of participants will have an elevated status compared to other parties. Unlike miners, which is a special class but is entirely generalized and open to anyone with enough hashrate (decentralized), a hard-coded set of treasury addresses 'locks in' a selection of specific parties that will gain special privilege and influence (centralized).

This has knock on effects with regards to censorship-resistance, as a newly minted special class of treasury Beneficiaries have a significant and disproportionate say in what happens to the protocol, and can interpret what kind of "censorship-resistance" is important. The chain will, due to being inextricably linked to these entities, inherit the sociopolitical influences these organizations will necessarily be under, reducing the chain's ability to resist external demands for censorship.

A situation like The DAO Fork, for example, which is the prime example of a lack of censorship-resistance, is clearly more likely and possible to happen if the hard-coded treasury Beneficiaries collude; either by mutual interest of external threats. The beauty of ETC as it stands now is that there are no 'owners' or 'directors' of the protocol, and any such social attacks that threaten the sanctity of the ledger are easily repelled by it's toxic, lovable, but most importantly decentralized community.

Permissionlessness is also directly attacked by The Proposal, by definition, by baking in a 'permissions system' for managing Treasury Beneficiaries. We'll look into the details of this later on, but needless to say the implementation of a treasury will cross an important threshold in a significantly less permissionless direction.

We believe in a strong separation of concerns, where system forks of the codebase are only possible, when fixing protocol level vulnerabilities, bugs, or providing functionality upgrades.

Here we see that The Declaration of Independence directly forbids the implementation of The Treasury Proposal. It is not fixing a vulnerability or bug, and is not providing what can be reasonably defined as a functionality upgrade, as explained:

forks and/or changes to the underlying protocol shall only be permitted for updating or upgrading the technology on which Ethereum Classic operates

In the same way that The DAO Hard Fork was not upgrading the technology, which led to (and so must fall under the definition used by) The Declaration, we argue that The Treasury Proposal will not upgrade the technology; both The DAO Fork and The Treasury are purely socially motivated rather than providing technical benefits, and are not permitted according to ETC's lore.

It could be argued that ensuring the funding of core developers will eventually translate into a technical benefit down the road, but the same can be said for The DAO Hard Fork. A major factor in why The DAO Hard Fork was pushed for is the same for The Treasury Proposal; for the financial interests of a group of core developers.

internal project development can be funded by anyone, whether via a trusted third party of their choice or directly, using the currency of their choice on a per project basis and following a transparent, open and decentralized crowdfunding protocol

This is another section of The Declaration that clearly and explicitly rules out what is being proposed by ECIP-1098; The Treasury is far from what is described as a "transparent, open and decentralized crowdfunding protocol", which refers specifically to crowdfunding, a commonly understood voluntary application-layer fund-raising mechanism, not a protocol layer dev tax.

We encourage that these principles not be changed via edict by any individual or faction claiming to wield power, authority or credibility to do so.

We are reminded that proposals such as The Treasury were expected to arise eventually; the potential rewards are obvious and it is human nature to gravitate towards such solutions.

We likewise will openly resist the “tyranny of the majority,” and will not allow the values of the system to be compromised.

Here we reinforce the intention of resisting any change that is pushed on the community without it's overwhelming support. Then as today, any unilateral action from tyrannical majority should expect to inflict a chain split.

A Crypto-Decentralist Manifesto

Arguably the second closest to official description of ETC values is "A Crypto-Decentralist Manifesto", by Arvicco, an ETC OG and serial contributor during the very early days.

As with The Declaration, The Manifesto was posted and widely shared in the ETC community and it provides further clarity by elaborating on the important idea of protocol neutrality. Neutrality and decentralization are pretty much synonymous; you cannot really have one without the other.

If The Declaration is the why of ETC, then The Manifesto is the how, and provides some very specific guidance that is designed to keep ETC decentralized for a long period of time by signaling a strong stance against any potentially centralizing developments.

It begins:

Not all blockchains are created equal. There are three key characteristics, that make scalable blockchain-enabled cooperation possible: openness, neutrality and immutability.

The document proposes that the secret of maintaining the previously described "decentralized, censorship-resistant, permissionless" ETC blockchain is by utilizing three new characteristics - "openness, neutrality and immutability".

At first glance it might appear that The Manifesto is simply rehashing The Declaration by using slightly different wording, but our interpretation is that these new characteristics are guidelines or instructions rather than outcomes themselves. In the same way a person must exercise, sleep and eat well to maintain their health, a blockchain must be open, neutral and immutable in order to be decentralized, censorship-resistant and permissionless.

These are, in our opinion, three pillars that give rise to blockchain utility and longevity.

Neutrality is necessary.

Necessary is a strong word. We see that The Manifesto and the participants who agree with it argue that neutrality is a prerequisite; it is non-negotiable and should be prioritized.

It’s important for anyone participating in blockchain-enabled cooperation to be on an equal footing with everyone else.

Here we get a precise definition that strikes a fatal blow to the very concept of a protocol layer Treasury. The idea that all participants are on equal footing with everyone else is incompatible with any system that elevates some individuals or groups over others.

Remember that we are concerned here only with protocol design. Anything that happens on chain (above the protocol, in the application layer) is governed by individuals' voluntary interaction via code is law, following contract code that can be neutral or not depending on the application. In order to uphold code is law itself, the protocol itself must be be neutral.

Also note that protocol neutrality is entirely compatible with mining, where there are no non-neutral built-in assumptions about who is receiving the block reward. The protocol just objectively dishes out a reward based on whoever is able to provide hashes; all parties are treated equally in this regard. This type objective neutrality is impossible to achieve when dealing with the fuzziness of rewarding development or other "meatspace" concerns. To keep the protocol neutral, it must not implement an inherently subjective system such as a Treasury.

The rules of the game are exactly the same for everyone, period.

Reiterated, once again, is the importance of protocol neutrality. We believe that because The Treasury directly contradicts The Manifesto, for this reason alone it is a non-starter.

Without neutrality, the system is skewed towards one set of participants at the expense of others. In that case, it’s less likely to gain universal acceptance and maximize network value for everyone.

While The Manifesto doesn't drill into the ins and outs of how you get from less neutrality to less universal acceptance and network value, the link is made, and we will explore this idea in a later section. For now, we'll just point out that even (or perhaps especially) back then, it was recognized that neutrality is a fundamental requirement.

The rules governing the blockchain network are known in advance. They’re exactly the same for everyone and not subject to change other than with 100% consensus. Yes, it must be 100%. Because any change to the system’s rules that not all participants freely agree to creates a network split, diminishing network value for everyone.

This section highlights the major reason why should be incredibly cautious about pushing for a controversial proposal, and is the main motivation for us to raise the alarm bell by writing this piece: the risk of a chain split.The Manifesto correctly points out that even a small minority of dissent will result result in a chain split, an outcome we see as being all but certain in this case.

A chain split is obviously a big kahuna event and is, to say the least, usually something that participants in a blockchain project try to avoid. If it is absolutely necessary, such as in the case of ETC's creation, then sometimes they can be positive events, but we argue in a later section that at this juncture it would lead to a tumultuous outcome that can only be avoided if The Treasury Proposal in it's current form is significantly revised or abandoned.

It’s impossible to achieve these blockchain characteristics without the system being truly decentralized. If any aspect of the blockchain system becomes subject to centralized control, this introduces an attack vector enabling the violation of one or more of the key blockchain characteristics. It may be possible to limit participation (such as by enforcing AML/KYC rules), thus violating openness. It may be possible to enforce discriminatory policies (such as by filtering “illegal” transactions), thus violating neutrality. It may be possible to rewrite the history of events (such as by confiscating or “redistributing” funds), thus violating immutability. Introducing centralized choke points creates a precondition for the introduction of “blockchain intermediaries or controllers”, who can siphon value out of the system at other participants’ expense.

The implementation of a protocol-level Treasury, as predicted here by The Manifesto, will lead to the creation quasi-foundation which will become the arbiter of decision making. Should/can/will the Ethereum Classic Foundation be good stewards of the chain they operate? We explore below.

The Sinking Ship

What appears to be the strongest argument that is put forth in support for The Treasury Proposal is that without a Treasury, Ethereum Classic will fail. It goes something along the lines of "without a protocol-layer Treasury, ETC development won't be funded, and therefore ETC itself will stop innovating, fade into insignificance or be vulnerable to exploits". ETC is a sinking ship, they say, which can only possibly be saved by changing the rules of the game and redirecting a bunch of money away from mining security to a handful of preordained client developers.

Bologna, say we.

Not only is this argument obviously empirically untrue thanks to the many other examples of successful non-treasury-funded blockchains such as Bitcoin, but it also undermines the achievements and current position of ETC; Ethereum Classic is itself proof that it doesn't need any official development effort or dev tax to reach a multi billion dollar market cap. On the contrary, we believe that ETC's lack of centralization has enabled it's survival.

To work with the metaphor - ETC is not a sinking ship; it's a rocket ship. A rocket ship that's fueled up and waiting for the right weather conditions to blast off to Mars. The last thing it needs right now is to siphon away that fuel by thwacking the side of the rocket with a pickaxe - a move that will most certainly damage the integrity of the ship and ruin it's ability to get to Mars at all.

An Answer to 51% Attacks?

The first point to make on the topic of necessity is that The Treasury Proposal was pushed hardest for in Q3 of 2020 in the midst of a series of worrying 51% attacks against ETC. At the time, these attacks appeared to be an existential threat and many in the community were in panic mode and open to answers - any answers - that would help alleviate this immediate problem.

Luckily, since then, alternatives were mulled and implemented, and since the Thanos upgrade in late 2020, ETC has not been a victim of a successful 51% attack (thanks to all those who worked on Thanos and MESS). MESS is not without controversy and some believe it should be removed, perhaps once ETC becomes the apex predator of Ethash, but that's another topic.

In hindsight, even though The Treasury Proposal was presented as a potential answer, with regards to solving 51% attacks, history has proven it to have not been necessary.

Further contemplation suggests that a treasury is unlikely to be strongly preventative against 51% attacks and could in fact make things worse - by directly taxing the hashrate and thereby making attacks cheaper, as well as the many other indirect drawbacks we're about to dive into.

In this new post 51% attack context, many ETCers have had time to calmly reflect on The Treasury Proposal solution and are now firmly against it as a solution to 51% attacks.

Move Slowly and Don't Break Things

Critics of chains like Bitcoin cite a lack of rapid development and comparatively little innovation, but we firmly believe that this is a feature, not a bug. During the growth phase that ETC is now in, adoption relies on a solid foundation. Similarly, the underlying protocols of the internet like HTTP and IP didn't need to innovate continually and radically to achieve mass adoption; once deployed, messing with these protocols too much would have risked hampering uptake by breaking compatibility or otherwise increasing friction.

For ETC, too, little innovation happening to the base protocol isn't a bad thing; it is not competing to be "Blockchain 3.0" against the likes of Cardano, Polkadot or Ethereum v2, and plenty of innovation is already happening in the contract layer thanks to Ethereum compatibility. Once Ethereum Mainline descends to Proof of Stake and 2.0, ETC is well positioned to fill the niche of being the "gold old" Trustless World Computer chugging along on the boring old rules that don't change much and are therefore reliably consistent over time.

To reduce friction is to enhance network effects, and to maintain both, blockchains as with the internet protocols should see innovation happen in a layered approach - protocols on top of protocols - like Lightning Network, Optimistic Rollup, DeFi, the IP stack, browsers and websites; increasingly complex applications on top of their largely static protocols. Attempting to push innovation onto an already established protocol (by allocating 90% of all Treasury funding to client development) represents a misallocation and a misunderstanding of where the innovation is going to happen.

If rapid protocol-layer innovation is sought after, there are thousands of other greenfield projects that offer an opportunity to experiment without risking ETC's existing foothold. One of ETC's unique selling points, a rare gem in the blockchain space, is that like it's spiritual big brother BTC, it doesn't require rapid innovation on the protocol layer to cash in on it's main strength of decentralization, which would be traded away by the implementation of a Treasury.

Note that we're not against all protocol innovation - that which is low risk, not controversial, and can be incrementally implemented slowly and methodically without negatively affecting compatibility would be a good place to start, but given ETC's already flexible contract layer, there is no need to jump the gun in the name of protocol-layer innovation, especially if doing so has significant drawbacks.

Client Development: Essential?

The stated goal of The Treasury Proposal is to fund both client development and the wider Ethereum Classic ecosystem. The Proposal makes the distinction between these two areas, in our view, arbitrarily, to ensure the selection of the the specific Treasury Proposal's Beneficiaries, allocating 90% of all of the funds to these three parties. Three client developers get the bulk of the funds because they are maintaining clients, in what we can only interpret as slight-of-hand that elevates the importance client development.

This decision appears to be framed around the idea that client development is the most important or essential element of a blockchain's success, so contributions related to client development should be prioritized above other areas. We believe the question of how to best allocate funds is far more complicated.

It's fair to say that some client maintenance is an essential requirement for a blockchain project; without at least one maintained client, a chain either doesn't actually exist (no software) or is open to newly discovered security issues, vulnerabilities or exploits (no maintenance); even if no 'features' are added, new releases will be required periodically to keep up with the ever changing adversities of cyberspace.

Practically, to keep a chain competitive and marketable it may also beneficial to not just maintain a base feature set but also upgrade and expand the functionality of blockchain clients and grow the wider ecosystem; this work is not strictly essential - the chain could technically survive without it - but highly desirable. These "non critical" roles go beyond the basic maintenance of one core client and include things like R&D, authoring of ECIPs, client redundancy, community management, marketing, maple syrup, conferences, evangelism, shit-posting, wallet development, dapp development, network monitoring, testing, etcetera.

The stated goals and internal logic of The Treasury tells us that it goes beyond the funding of "essential" and into the "nice to have", as it will be funding the development three clients in total. We are told that that it is best to allocate the vast majority of resources to the the teams responsible for the development of additional clients rather than towards other potentially far more important areas. As we elaborate on later, we believe this is a serious misallocation.

For now we just wish to dispel the idea that "client development" is the same thing as "essential development"; very quickly, client client development goes beyond the point of core maintenance requirements, and should not necessarily be elevated above other types of contributions or parties as it is in the current model.

No Premine

Some say that in fact ETC is already relying on a treasury or sorts, or at least centralized funding that is running out and needs to be replaced. This is partly true, as the ETH premine, some of which (in the form of post-DAO-fork ETC) was graciously transferred to ETC Cooperative and was in turn to fund development and other ecosystem activity.

Our answer to this is that whilst these funds did lead to valuable contributions to ETC, they represent only a small portion of the total contributions from the plethora of sources that the wider community has provided overall; financially or otherwise. We note that ETC was live and kicking long before this premine was put to use, and ETC would still be alive without it.

We also later go into some more arguments about why The Treasury and a premine are very different beasts.

The Gitcoin Bribe

Gitcoin is a third party grants system that exists to fund the development of public goods in the Ethereum ecosystem, and whilst it has it's flaws, it has successfully created an active ecosystem and delivers on it's goals. The Treasury proposes that 10% of the dev tax is allocated to Gitcoin, presumably to be used on ETC-specific grants.

Gitcoin itself is a promising project and we would support initiatives to integrate it with ETC on the application layer, but like The Treasury contract itself, baking in a such a complex, centralized and non-battle-tested system into the core ETC protocol is asking for trouble.

We won't delve deep into the Gitcoin-specific centralization points and pitfalls, other that this: Gitcoin uses Github for user verification. Gitcoin and quadratic funding in general relies on the assumption of sybil resistance to ensure fair allocation of funds (essentially to prevent vote rigging). One of Gitcoin's first line of defence against sockpuppets is to use Github accounts for identity.

This means that Treasury proponents want Github, and ultimately, their owners Microsoft, to have a protocol-level active role in the operation of Ethereum Classic, which strikes us as the antithesis of ETC's reason for being. If this is considered and acceptable standard for Treasury proponents, what kind of future compromises should we expect in other domains?

The (rather insulting) 10% of the proposed tax, as what appears to be a token gesture, that is allocated to Gitcoin grants is in theory supposed be used to fund all other types of ecosystem development that is not handled by three ordained client maintainers. The more cynical have noted that this inclusion may be a way to tempt non-client-development participants into supporting The Treasury with the potential of receiving grant money.

Regardless of whether Gitcoin is seen as acceptable in terms of decentralization, can use it to reveal the (rather convenient) logic of Treasury Proponents: The Treasury will be used for funding all kinds of activities, not just client maintenance, and of these activities, only a tiny fraction should be allocated to anyone other than the three client maintainers. How convenient.

One huge issue with funding these non-essential activities is that it does not come for free - most directly in the form of reducing hashrate by taxing miners. Why should ETC sacrifice any mining hashrate, which is absolutely essential, not just 'nice to have', in exchange for evidently non-essential activities.

To go back to the sinking ship metaphor - why cut back on hull reinforcement in order to serve caviar on the life rafts?

Blockchain Seppuku

Without yet addressing the hard technical problems with The Treasury system, in this section we hope to explain how The Treasury is likely to fail in it's own stated goals of increasing contributions to Ethereum Classic.

We believe that implementing a Treasury will, overall and in the long run, result not in increased contributions but a net reduction of sustainable natural contributions to Ethereum Classic and will be regarded by history as a counter-productive and life-shortening act of self-evisceration. In this section we step through the logic of how this might happen, which we hope can serve as a warning against implementing a Treasury or similar proposals.

The Three Pillars of Decentralization

Like a real world construction, blockchains rely on interlocking and counter-balancing incentive systems that amalgamate into strong social structures. Messing with the fundamentals of these structures even a little bit can have cascading effects that cause the whole house of cards to tumble.

For this reason we should be very cautious when implementing any protocol change that potentially affects the configuration of a blockchain ecosystem's incentive structure, which has many intricacies depending on the deployment, but in the case of ETC relies heavily it's core pillars of openness, neutrality and immutability.

To mess with these properties is to mess with the structure of ETC itself. Weakening one pillar in even (what appears to be) a small way may cause the system to become unbalanced and collapse.

We believe that a Treasury Proposal in particular will represent (at the bare minimum) a perceived effect on the protocol's level of "openness", "neutrality" and "immutability" in various ways, and risks the unravelling of the system.

We acknowledge that Immutability is not brazenly abandoned by The Treasury Proposal as it does not intend to introduce any "surgical irregular state change" in the same obvious way that The DAO hard fork did. However, the idea of philosophical immutability (ETC's principles shouldn't change) is certainly at stake and this type of immutability arguably just as important as it is what upholds the former applied immutability (against irregular state changes).

Openness is also reduced as the the ability to become a Treasury Beneficiary is not equal access. Not only is this process unclear as there is no procurement process outlined by The Proposal, but it introduces a necessarily permissioned system, with big whales becoming the new gatekeepers.

The primary pillar that is under attack by this proposal is that of Neutrality, which is thrown to the wind as the protocol recognizes a whitelist of special addresses that will become dev tax Beneficiaries.

Protocol Neutrality

As we noted above, The Manifesto argues:

It’s important for anyone participating in blockchain-enabled cooperation to be on an equal footing with everyone else. ... Without neutrality, the system is skewed towards one set of participants at the expense of others. In that case, it’s less likely to gain universal acceptance and maximize network value for everyone.

Unfortunately, no further details are given as to how exactly this is likely manifest, but we will attempt to pick up where The Manifesto leaves off and contemplate how this might happen with ETC.

We argue that the various attributes or configuration parameters that a blockchain can offer will result in it's actual and perceived level of neutrality. A blockchain project can therefore have various different levels of neutrality that will yield varying outcomes in terms of network value and universal acceptance. Neutrality, as with decentralization, can be plotted on a spectrum in a similar way as we did above.

Maximizing acceptance relies on maximizing decentralization, which relies on maximizing neutrality, which is in turn maximized by selecting the relevant attributes of a blockchain protocol. We can interpret the term unequal footing to mean a non-optimal configuration of a protocol's features, in a way that does not maximize neutrality. If a blockchain has features that mean all participants are not treated equally from the point of view of the protocol, it is not neutral.

For a blockchain to be maximally neutral and therefore maximally decentralized, it must avoid baking into the protocol (the code) any specific parties who are special. Examples of these non-neutral parties include:

- A built in list of validators (PoA)

- Premine recipients

- Pre-selected block reward recipients (e.g. Dev Tax)

- Some kind of transaction approval whitelist

One thing to make clear is the difference between neutrality in general and protocol neutrality. In this context, we're not trying to ensure that every party regardless of participation has exactly the same level of influence on ETC. Far from it, different parties should have different types and levels of influence based on the substance of their participation. It is natural that real world entities end up having various different levels of influence, and this is perfectly in line with the concept of protocol neutrality. As long as the protocol does not refer to the identities of these parties and allows anyone to fill the role, the protocol remains neutral.

Examples of protocol-neutral parties with different levels of influence might include:

- Miners

- Developers

- Educators

- Influences

- Improvement Protocol Authors

An Unequal Footing

If protocol neutrality is sacrificed, this may yield some immediate benefits for specific parties, but we believe the unintended consequences of such changes certainly exist, as flagged by The Manifesto.

We are now in the novel world of blockchain socioeconomics, where decisions about what lines of code to implement intersect with the complexity of markets and memes. Exactly how things pan out is impossible to say with certainty, but we hope to forecast a scenario of what happens when neutrality is sacrificed that is both plausible and reason for concern.

Whilst protocol neutrality itself can be fairly objectively defined as we have done so above, individual participants involved in a blockchain's ecosystem may have different subjective beliefs about what they are willing to accept in terms of centralization tradeoffs.

Individuals, too, will change their mind over time based on real world events. If, for example, a major chain such as Ethereum was pressured by it's leadership to once again tamper with immutability, we may see another generation of participants who are strongly convinced that neutrality is of primary importance, even though it wasn't perceived to be a much of a big deal before. Neutrality refugees will be looking towards chains that represent their newly appreciated understanding. Over time we predict that demand for neutrality will increase as less neutral chains fall victim to centralization.

Many casual participants are purely in it for the Lambos so are completely indifferent to a chain's underlying philosophy; they do not care about centralization at all - like fanboys of Ripple or Binance Chain (not throwing shade, these are just examples of centralized chains). This is true of many traders, who collectively hold assets in all cryptocurrencies, Ethereum Classic included.

ETCian DNA, however, was originally filtered through the The DAO Fork and the egregious lack of protocol neutrality it entailed. We could therefore reasonably assume that ETC has the highest concentration of protocol-neutrality-concerned participants out of all blockchain projects - even more so than Bitcoin in relative terms.

New projects offer a good opportunity to experiment or refine what is acceptable in terms perceived neutrality, but as there is no know way of measuring before hand whether a protocol upgrade is likely to cross the line among it's existing community, we believe that it is better to err on the side of caution rather than placing a bet on the hope that the balance is not tipped and a protocol loses it's appeal.

Because of this, for existing projects, we believe the only responsible approach to neutrality is to try and maximize it at all times. ETC in particular should never attempt to make a change that sacrifices perceived neutrality, as the extent to which it's effects are likely to impact the system are unknown, and compared to most chains, more likely to be fatal.

Natural vs Artificial Contribution

Software projects in general and public blockchains in particular can receive contributions (development, evangelism, etc.) through various means. One distinction that could be made is that of "natural" and "artificial" contribution types.

Basically, we define natural contribution as contribution to a project that is provided without direct financial remuneration; motivations may be for personal development reasons, philosophical, social, political, indirectly financial (buy and contribute), etc. This is in contrast to artificial contribution that is made in exchange for funding via a dev tax, a premine, crowdsale, etc; incentivized mercenaries for hire, who are primarily motivated by money and not particularly loyal to any project.

We believe that natural contribution is the lifeblood and key to long term success of any blockchain project; it has some extremely powerful features:

- Most importantly, natural contribution encourages all kinds of contribution and dynamically adapts to changing environments and opportunities

- It is sustainable over the (very) long term via the "buy and contribute" strategy

- Purpose-driven contributions are incentivized in addition to financial rewards, which can attract talent that may otherwise not interested

- Self-selecting participants optimise contributions by utilizing their own skill set as best they know how (as opposed to being misallocated a role)

- Self-reinforcing over time as due to network effects and contributions lead to price increases leading to further contributions

- Antifragile base of contributors are free from central points of failure as they associate in a bottom-up way rather than being directed from the top-down (though independent teams may also form and act in groups or companies)

The primary drawback of natural contribution is that contributions may be unreliable, and if a project is unable to gain enough initial momentum to attract a critical mass of contributions to 'get things going' in it's nascent stages, the risk of the project never getting off the ground remains a possibility. However, once a decentralized project reaches some degree of maturity and independence, it's incentive structure should be self-sustaining and by definition should not need to rely on anything other than natural contribution.

It is in these nascent stages where artificial contribution can be useful for decentralized blockchain projects - they start by bootstrapping with centralized artificial contribution mechanisms, with the goal of shedding this reliance and becoming decentralized so that they can operate indefinitely on natural contributions.

The main limiting factor for artificial contribution is lack of long term sustainability and it's inherent reliance on some degree of centralization. Artificial contributions are necessarily directed by an organizing committee of some sort, which itself has a limited lifespan - a foundation, or company, or whoever controls the stipend.

Squaring the Coordination Problem Circle

Natural contribution is incentivized not just by passion or street cred in the way that typical FOSS contributors are, but also financially due to the buy and contribute strategy, which encourages participants (to the extent that they are on an equal footing) to not only buy into a blockchain (increasing it's security), but also to contribute to the success of a chain in a way they feel will be most effective - in a purely 'selfish' manner in order to increase the value of their holdings.

This, we believe, is the magic at the heart of truly decentralized blockchain projects as it neatly solves decentralized coordination. Praise Moloch.

This mechanism has subtle but powerful effects and fairly distributes rewards in a decentralized way to those who are willing to take financial risk and/or bring benefit to the protocol in a broad number of ways; any thing that increases the value of the chain will by definition benefit holders of ETC, which can range from making memes to submitting PRs, and other contributions that are impossible to fund artificially.

It is this mechanism that has held ETC and many other blockchain projects together so far and has nurtured an entire decentralized blockchain ecosystem into an eye-wateringly valuable human achievement. Since the Bitcoin genesis block this self-reinforcing mechanism has only gotten stronger over time and created greater incentives to contribute - there is no reason to believe this trend will change as long as the protocol remains neutral.

Fair Shares

The extent to which the buy and contribute strategy makes sense is directly related to the extent to which a protocol is perceived to be neutral.

To illustrate this, take for an extreme example a very non-neutral protocol configuration; one that is premined by 100%. If close to 100% of the liquid supply of a chain is controlled by a few parties, any participant that buys and contributes has to grapple with the possibility of having their holdings liquidated by 100%; those mega-whales will always reserve the ability to dump their whole stack on the market making the value of the tokens of other contributors worthless. In this case, not only do contributors lose their initial investment but also (and possibly more frustratingly) the time and effort they spent contributing.

The same is true to a lesser extent if we increase the neutrality of a protocol slightly. Let's say instead of a 100% premine, it's a 50% premine. Nothing has fundamentally changed here, the risk is simply is lowered. We argue that what is true for premines is also true for a dev tax, and is in some ways worse.

Note that we're not suggesting that the only outcome is for mega-whales to dump their entire stash as the effect occurs to some extent whenever a party sells their holdings; when this happens it necessarily reduces the value of everyone else's holdings. If contributors want to minimize their risk and maximize their profits, it is in their interest to contribute to whichever blockchain is the most neutral (all other things being equal).

Contributors understand that it may take a long time before their contributions mature into actual value-add for the network, and the market may take additional time to recognize this and translate this potential value into actual dollar value. For this reason, it's not just present neutrality but also future neutrality that must be protected in order to convince potential contributors to provide value. Even with a 100% neutral protocol today, no sane contributor would buy and contribute knowing that a fork is due tomorrow that will dilute their holdings by 100%.

It is rational to assume that any trend towards a reduction in neutrality opens the door for this continue in the future, which directly reduces the benefit of contributing today.

Competition for the Neutrality Niche

Blockchain projects do not exist in isolation, and are competing against each other for contributor mind share. All things being equal, we should expect new contributors to make the simple calculation above, act in their rational self interest, and contribute to what they perceive to be the most neutral protocol.

We believe that this phenomena explains why many of the small cap and unfairly distributed blockchains rarely manage to garner enough natural contribution to reach self-sustainability, and why shifting away from neutrality (even a tiny bit) poses a significant risk of being out-competed by other more neutral chains and losing developer mind share in the long run.

Like many systems in nature, winners do not appear immediately and may at any given stage appear to be ahead or behind their competition. In the same way, the quiet importance of neutrality might not be obvious in short run, especially when other chains have lots of bells and whistles generating interest, but in the long run, we believe it will prove be one of (if not, the) most important factors in blockchain utility and longevity.

This argument stands independently of whether or not a majority claim that neutrality is maintained; even if a protocol is made to feel unfair subjectively to some participants, it is likely that natural contribution will be reduced as contributors migrate to chains that do not feel unfair.

The Centralization Gravity Well

The hazards of drifting away from neutrality towards centralization might appear to be worth the risk if made in a limited way; the benefit of being able to deploy artificial contributions might outweigh the potential reduction in natural contributions. Granted, there are situations where this may make sense, such as during the bootstrapping of a project.

One way to analyse the problem is to understand the direction and velocity of travel with regards to protocol centralization - is a protocol becoming more or less neutral, and by how much over time?

Different types of centralization have different impacts and are more or less likely to yield negative outcomes. In particular, there are some types of protocol changes that are likely to feedback on themselves and compound to create further centralization over time; they could cause the project to tumble down the centralization gravity well.

In this scenario, the negative effects of a non-neutral protocol changes might not appear immediately, but will metastasize over time. As it becomes clear that decisions are being driven (even ever-so-slightly) not by a neutral commitment to the success of the project but to the financial interests of some other group, non-Beneficiary participants become less inclined to contribute, there is less resistance to these types of proposals, centralization is further reinforced, and the cycle repeats.

This centralizing feedback loop roughly works as follows:

- A problem, weakness or vulnerability is identified (e.g. low hashrate, 51% attacks, lack of development)

- A group uses the problem to justify the implementation of a protocol change that benefits specific participants over others

- Beneficiaries receive financial resources giving them the means and motivation to make similar changes

- Non-Beneficiary participants become dissuaded from participating and sell off their holdings

- Opposition against similar changes decreases, the protocol loses value, mining becomes less profitable, and the community shrinks leading to less evangelizing

- Problems arise due to this weaker system

- Go to step 1, repeat

We believe that a Treasury is a feature that yields this type of centralization; Treasury Beneficiaries will continually secure more and more influence over the protocol, making it increasingly difficult to break the cycle.

Misallocated Resources

The existing Treasury Proposal rests on the assumption that diverting funds away from mining and using those funds to support "client development" is a more efficient use of resources. In theory this could be true, but we believe that at the very least there is a debate to be had about how Beneficiaries should be selected and what level of funding they receive, such that resources are allocated in the most efficient way possible.

The Treasury Proposal explains that in the interests of simplicity, a three-way split between the existing active client maintainers is a fair enough way to allocate the dev tax for the 5 year duration. Clearly, unless these three dev teams are to provide exactly the same amount of value to ETC, this is bound to create misallocation of resources, and we feel this is something that should at least attempted to be addressed.

There is, for example, no weighting in terms of funding or incentive based on the actual usage of said clients; even if there is extremely low usage of the additional clients (and such do not provide as much value to ETC in return), the maintainers of these clients still receive the same amount funding, which could instead be directed to towards improve the client(s) that are used, or other areas that need funding.

A bigger problem in terms of misallocation is that the price of ETC is guaranteed to fluctuate over the course of The Treasury operating, but the amount of ETC given to Treasury Beneficiaries remains a fixed % of the block reward, meaning they are likely to end up with much greater or much smaller amounts of spendable resources (USD) than they anticipate. We go into this problem in detail a bit later when we take a closer look at the details of the proposed contract.

Perverse Incentives

To reap maximum rewards of Beneficiarydom, it is necessary to keep out new Beneficiaries (other client maintainers who want a piece of The Treasury pie). Financially incentivized and empowered by funds from The Treasury, existing Beneficiaries should be expected to shore up their position by spending funds not only on improving ETC, but more importantly (for them) ensuring they exclusively retain their Beneficiary status. We can therefore expect treasury funds to be spent on PR, advertising, vote buying, kickbacks to influencers, misinformation campaigns, etc; anything that may help maintain their status as Beneficiary and prevent others from becoming one.

In theory, checks and balances should operate as a counterweight and enforce good behavior such that Beneficiaries can only remain in the position if they deliver for ETC. In practice, however, the terms of the contract make this a practical impossibility.

The combination of strong incentive, financial means, and uphill battle for de-throning Treasury Beneficiaries means that we are likely to end are likely to end up with a permanent ETC client maintainer triopoly who are in a race to the bottom to contribute as little to ETC itself as possible, instead directing funds towards maintaining their status as Beneficiary and keeping the rest as profit. There is little incentive to over-deliver (or indeed deliver at all) as they all receive a fixed amount of ETC regardless of what they contribute to the protocol; the less they spend (or rather, the more they pretend to spend) the better.

The Client Triopoly

At this point, Treasury proponents may make an argument along the lines of "new client maintainers are free to work on their own client without being in The Treasury, just like they do today without one". This line of thinking is plausible at cursory glance but we have shown that the presence of the dev tax is likely to to disincentivize this kind of natural contribution.

On Ethereum Classic Treasury Edition, whilst it is true that third party maintainers could work on other clients without receiving any dev tax, as we have explored, in reality this is very unlikely as the incentives don't line up. It would require that third party contributors are happy with subsidizing Treasury Beneficiaries with their labor, doing the job of client maintenance, with (what should be) their salaries going to the entrenched Treasury Beneficiaries, when they could instead be receiving the fair full value of their contributions by working on another chain.

To remedy (but not cure) The Treasury's entrenchment issues, at the very least there should be a clear set of guidelines to describe what is needed to qualify as a Beneficiary. If the purpose of The Treasury really is to incentivize (diverse) client development, a procurement and tendering process should be outlined, ideally in a way that incentivize the inclusion and recommitment of once popular ETC clients like MultiGeth and OpenEthereum.

Whilst the main justification for implementing a Treasury purports to maintain client diversity, it is reasonable to assume that it may end up having the opposite effect.

Non-Essential Workers

We also question the logic of over-emphasizing the importance of client maintainers as far as Treasury funding is concerned. The existing selection criteria asserts that The Treasury should prioritize the development of two specific additional (and potentially redundant) ETC clients over other potentially much more useful areas, in a similar way to how ETH Foundation grants operate:

- As mentioned, resurrecting popular clients OpenEthereum and MultiGeth

- Critically, ECIP research and engagement arguably the most important activity as client development is downstream of this

- Critical infrastructure such as Web3 endpoints

- Third party audits of the exiting ETC protocol and client codebase

- Beyond the 10% via Gitcoin (which is just for short term grants), an on-chain mechanism to fund long term contributions from other teams or organizations in the ETC ecosystem that have a track record of delivering; e.g. Commonwealth, authors, evangelists, and other smaller but value-adding ETC participants

We can hear the retorts already: "The three client maintainers will expand operations to do all this". A very convenient answer for the maintainers, but why not, if the goal is for ETC to flourish, create a funding mechanism that is open, transparent, and fair to all participants, such as those with a proven track record for providing these services to ETC already?

Because of the complexity and inability for a decentralized blockchain protocol to fairly and efficiently allocate funds due to the many fuzzy and fluctuating factors involved, it is our belief that the only remaining way to handle this is to give all participants, including client maintainers, exactly the same amount of funding: zero.

Worse than a Premine

One argument that may be submitted as proof that a Treasury does align with ETC principles and that our centralization concerns are overblown is that a similar event happened in the past: The ETH premine, which ETC inherited.

We believe this point can be countered in a number of ways - one is by recognizing that the premine could well be considered a catastrophic centralizing event that is still unfolding in ETH land. It may be that this is what enabled The DAO Fork after all, as a major contributing factor was to protect the (disproportionally premined) financial interests of those calling the shots.

In this way we can be glad that Ethereum Classic was able to split away from it's centralized parallel universe, as the premine has relatively little influence on ETC post-fork when ETCians fairly hoovered up the "free money" dumped by ETH whales. Perhaps participants could be forgiven pre-DAO for not recognizing the importance of avoiding centralization, but lessons should be learned from this mistake and the neutrality needle shouldn't move further in the wrong direction if it can be avoided.

But regardless about how we interpret the past, the existence of the ETH premine does warrant discussion, and we believe that a consistent position can be held that accept a premine but rejects a treasury as they represent fundamentally different tradeoffs in terms of neutrality.

The first difference is that, unlike a Treasury, the ETH crowdsale was open and permissionless - open to all and without KYC or whitelists. Anyone could send Bitcoin to a crowdsale address and would later be credited with ETH, fully knowing the terms ahead of time.

Further, Ethereum itself didn't exist before the premine - it was used to bootstrap the project and wasn't changing the rules of anything mid-flight; the premine could be justified with "we need a bit of centralization now, but it will always be decreasing going forward", which was more or less stuck to.

Unlike the ETH premine, as a one off event with a known upfront neutrality cost that would be diluted by block rewards over time, implementing a Treasury at this stage flips the direction and velocity of centralization and opens the door to future taxes, extensions of The Treasury, or similar misplaced changes. A Treasury such as the one proposed is likely to be a growing rather than shrinking type of centralization pressure; it aligns incentives in a way that makes the dev tax at least difficult to remove and at worse destined to increase - to understand why we need only ask: what happens when it is supposed to expire?

1,825 Days Later

Some Treasury Proponents wish to limit the potential negative effects of a Treasury by implementing a time limit, with the suggestion of 5 years gaining traction in the ETC discord chat room.

In this case, after 5 years, The Treasury contract reaches it's expiration. It goes poof, and the funding is stopped. The salaries of all the developers maintaining the three ETC clients are gone, they are "fired" by the protocol, and they will sadly have to go back to working on other projects.

It's now game over for ETC because thanks to The Treasury client maintenance competition has gone extinct, no alternative business models are incentivized to emerge, and now funding is cut off from the only remaining client maintainers. Nothing has fundamentally changed from pre-treasury to post-treasury, indeed things have gotten worse as business models haven't been able to adapt to a non-treasury world. Following the logic of implementing a treasury to begin with, ETC is still fundamentally a "sinking ship", but now there's nobody left to rescue it.

It is easy to predict what is really going to happen after 5 years: just like the difficulty bomb, The Treasury will be extended. The salaries of those who get to decide what code is implemented depends on it, after all.

The cynics among us may point out that the "5 years" clause is a bait-and-switch designed to lessen the perceived impact of implementing ECIP-1098, but it is precedent itself that is the problem. We can see that accepting the logic of having a treasury in the first place is to accept that it needs to exist perpetually.

By now we can hopefully see that rather than saving the sinking ETC ship, a treasury introduces the real risk of locking in a growing centralization pressure that eventually leads to it's demise in an avoidable act of Blockchain Seppuku.

The Ethereum Classic Foundation

We have discussed the possible dangers of centralization at a high level and how it can snowball out of control, but how might things look on the ground, specifically in the case of The Treasury? During the "5" years that The Treasury is expected to operate for, what kind of behaviors are likely incentivized by The Treasury system? What is ETC likely to get in for it's money; in return for 20% of block rewards?

One promise The Treasury will deliver on is the birth of The Ethereum Classic Foundation. Although is unlikely they will adopt this name, the 3 main Beneficiaries of The Treasury will become officially recognized group that by virtue of being hard coded into the protocol itself, and would therefore be even more "official" than the Ethereum Foundation is for ETH.

Regardless of the specific individuals that comprise The Treasury Beneficiaries, we will refer to this group as the The Ethereum Classic Foundation for clarity, as well as a tongue in cheek jab at the obvious centralization risks created by having an officially recognized group of developers and decision makers for ETC. Many blame the original Ethereum Foundation for being ultimately responsible for the DAO Hard Fork, a mistake and system failure that that was only possible due to this centralized authority, incentive structure, and the top-down decision making it enabled.

It is our belief that the centralized nature of the ETC Foundation is very similar to the ETH Foundation, and as such we should expect that the similar mistakes and failures that this centralization enables are more than likely to occur.

One Big Happy Family

What currently makes the ETC community unique and interesting is it's lack of central leadership. There's a social contract that has so far served ETC well enough to, despite huge opposition, to go from just an idea to a multi billion dollar project. ETC is a top 5 Proof of Work cryptocurrency, and one that is well positioned to become the premier Proof of Work Smart Contract chain.

What is the engine that has powered the decision making behind ETC's success so far? If we look at how things work now we don't see any central leadership, there's no foundation, no Vitalik. ETC on a human level appears to be disorganized collection of individuals and teams, and whilst the day to day discourse may appear anarchic, toxic or even antagonistic, this chaos leads to an emergent meritocratic order, a "do-ocracy" where the best ideas rise to the top.

Many disparate parties have agreed to rally behind in an intersubjective consensus based on the rules of the game as described by ETC's codebase, which is downstream of principles; to hold ETC is to agree to it's rules, an agreement that is fair, peaceful and efficient due to it's voluntary nature.

Within the ETC ecosystem, the more motived a participant is about a particular issue, the more effort they'll contribute - an effort that is not necessarily tied to any artificial financial remuneration. As we explored, it is the existing level playing field that allows for this kind of swarm intelligence to function; the rules of the game encourage this kind of contribution as individuals know they, just as anyone else, can really make a difference if they have the logic and conviction to convince others. We hope that in time our writing serves to prove this point.

From Meritocracy to Aristocracy

In contrast to how things work now, The Treasury Proposal has the potential to disrupt this intricate game theory incentive structure and cast away the decentralized decision making process that served ETC so far. The creation of a select group of "official" client developer teams will create an obvious central point of decision making. Just as with Ethereum Mainline with respect to The DAO Hard Fork decision, non-foundation participants, irrespective of previous commitment or actual ability to contribute, will not be on equal footing in terms of influence on the future of the protocol.

Basically, we anticipate that The Treasury will transform the human layer of ETC from a Meritocracy into an Aristocracy. Influence on the protocol will be exerted more and more by those who are within or connected to The Foundation.